20 Tips for Buying a Car Without Breaking the Bank

This guide offers practical advice to help you save money, make informed decisions, and confidently purchase a car that suits your budget.

- Daisy Montero

- 5 min read

Finding the right car at the right price is easier than you think. These tips cover everything from budgeting smartly to negotiating like a pro. The goal is to help you save money and still drive away with a car that works for you. You don’t have to overspend to get a great deal.

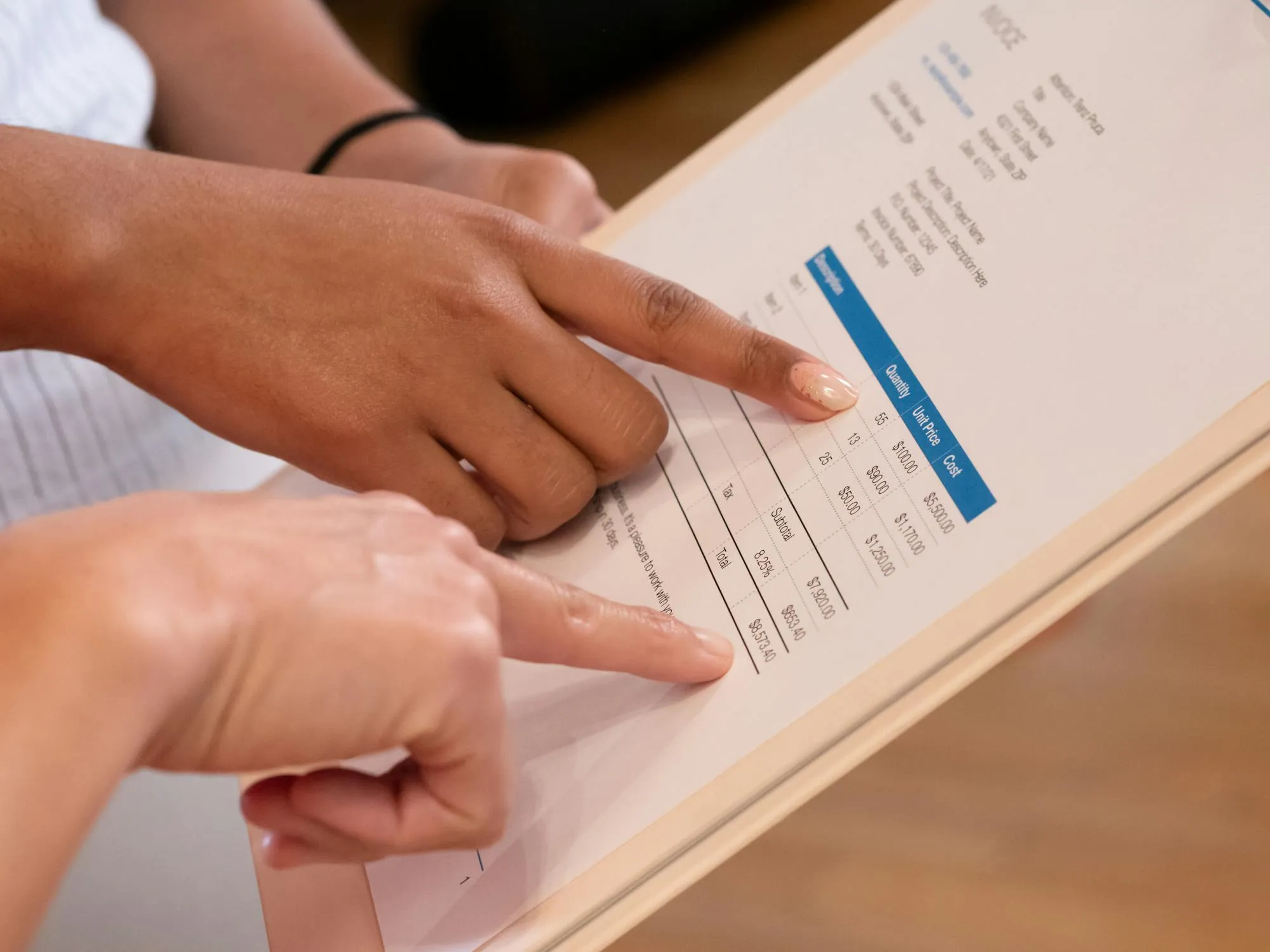

1. Create a Budget That Works

Monstera Production on Pexels

Monstera Production on Pexels

Start by figuring out how much you can realistically spend. Include costs like insurance, taxes, and maintenance so you’re not caught off guard. A clear budget keeps you focused and prevents overspending.

2. Choose Used Cars for Better Value

Erik Mclean on Pexels

Erik Mclean on Pexels

A well-kept used car can give you more bang for your buck than a new one. Look for models that are a few years old but still in excellent condition. You’ll save money while avoiding that big drop in value new cars experience.

3. Research Cars That Fit Your Needs

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Not all cars are equal when it comes to running costs. Research models with good reliability and low maintenance expenses. This step will save you money and frustration down the road.

4. Get the Car’s Full History

Ono Kosuki on Pexels

Ono Kosuki on Pexels

A car’s history report tells you if it has been in accidents or had major repairs. This small cost can prevent big surprises later, so always check it before making an offer.

5. Inspect Every Detail

Tim Samuel on Pexels

Tim Samuel on Pexels

Don’t just glance at the car; look closely at the exterior, interior, and engine. Watch for signs of wear or poor repairs that could mean trouble. A professional mechanic’s inspection is worth considering, too.

6. Compare Deals Online First

Edmond Dantès on Pexels

Edmond Dantès on Pexels

Checking prices online helps you spot a good deal when you see it. Look at listings for similar cars in your area to get a sense of what’s fair. This knowledge gives you an edge when negotiating.

7. Time Your Purchases Right

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Shopping at the right time, like at the end of the year, can mean better discounts. Dealers are often eager to meet sales targets during these periods, so waiting for the right moment can save you big bucks.

8. Take It for a Test Drive

FBO Media on pexels

FBO Media on pexels

A test drive tells you how the car performs and if it’s comfortable to drive. Try it on different types of roads to see how it performs. This is your chance to spot any issues or deal-breakers.

9. Look Beyond the Price Tag

Getty Images on Unsplash

Getty Images on Unsplash

The sticker price isn’t the only cost to consider. Think about things like added fees or warranties that could drive up the total. Being aware of these extras helps you avoid unexpected expenses.

10. Avoid Buying on Impulse

Getty Images on Unsplash

Getty Images on Unsplash

A flashy car might grab your attention, but take a step back before committing. Think about how it fits your budget and long-term needs. Rushed decisions often lead to regrets.

11. Read Every Detail in the Contract

Alena Darmel on Pexels

Alena Darmel on Pexels

Contracts can hide unexpected fees or conditions, so read them carefully. Take your time and ask questions if anything is unclear. It’s better to spend extra minutes now than deal with surprises later.

12. Be Ready to Walk Away

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Don’t feel pressured to settle for a deal that doesn’t feel right. There are plenty of cars and deals waiting for you. Walking away shows you’re serious about getting the best value.

13. Check for Smog and Emissions Compliance

Khunkorn Laowisit on Pexels

Khunkorn Laowisit on Pexels

Emissions tests are required in many places and can prevent future headaches. Before finalizing the deal, make sure the car passes all necessary checks. This simple step ensures compliance and reliability.

14. Factor in Insurance Costs

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Some cars cost more to insure than others, so get quotes beforehand. Sporty models or older cars can drive up insurance rates. Knowing these costs helps you make a smarter decision.

15. Review the Car’s Service Records

Kindel Media on Pexels

Kindel Media on Pexels

A car with regular maintenance records is likely more reliable. Look for consistent servicing and quick repairs for past issues. It’s a good indicator that the car has been well taken care of.

16. Choose Fuel Efficiency

Engin Akyurt on Pexels

Engin Akyurt on Pexels

Cars that get good mileage can save you a lot at the pump. Look at the MPG rating for city and highway driving. A fuel-efficient car is better for your wallet and the environment.

17. Consider the Car’s Age Carefully

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Older cars may cost less upfront but could mean higher maintenance expenses. Balance the savings against potential repair costs. A slightly newer car might save you money in the long run.

18. Be Wary of Prices That Seem Too Low

Getty Images on Unsplash

Getty Images on Unsplash

Deals that sound too good to be true often are. Very low prices can signal hidden problems or rushed sales. Trust your gut and investigate thoroughly before buying.

19. Negotiate Like a Pro

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Most sellers are open to negotiation, so don’t be afraid to counteroffer. Use your research on fair prices to back up your points. Every dollar you save counts.

20. Explore Financing Options

Getty Images in Unsplash

Getty Images in Unsplash

Financing through banks or credit unions can offer better rates than dealerships. Take time to compare options to find the best deal. The right financing plan keeps your monthly payments manageable.