20 Unexpected Perks of Using a Credit Union Instead of a Bank

Though many people may not be aware, credit unions have special advantages that regular banks sometimes ignore. This post looks into 20 unanticipated benefits of working with a credit union including improved customer service, less costs, and more customized financial solutions. A credit union may provide benefits that banks just cannot match whether your needs call for a location to save, borrow, or handle money.

- Tricia Quitales

- 5 min read

Regarding financial management, many people stick to banks without thinking through the other possibilities. Lower interest rates, a feeling of community, and an emphasis on member financial success are just a few of the unexpectedly good advantages credit unions offer. From access to member-oriented services to more flexible terms, this article will emphasize 20 surprising benefits of credit unions over banks, therefore clarifying their unique advantages. Deeper knowledge of these advantages helps consumers choose where to put their money and trust with more wisdom.

1. Lower Interest Rates on Loans

Kaboompics.com on Pexels

Kaboompics.com on Pexels

On personal loans, auto loans, and mortgages, credit unions usually provide cheaper rates. Being non-profit, their main goal is not profit generation but rather member benefit. For credit union members, this produces a more reasonably priced borrowing experience.

2. Higher Interest Rates on Savings

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Although conventional banks usually have poor savings account interest rates, credit unions are well-known for having superior rates. They also want to enable members increase their riches in another sense. Credit unions might enable you to earn more with less effort if you are trying to save money.

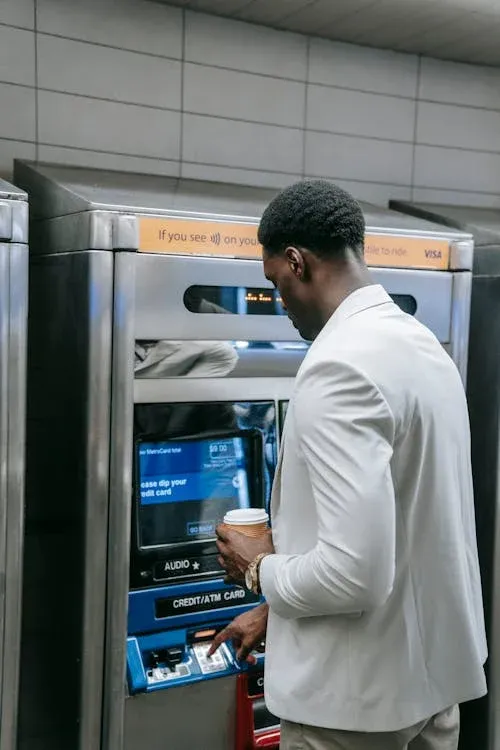

3. Lower Fees

Jack Sparrow on Pexels

Jack Sparrow on Pexels

For items like bank accounts, overdrafts, and ATM use—among other things—credit unions usually charge less fees. Being non-profit, they forward the savings to their members. This can make a significant impact, particularly for individuals weary of excessive bank fees.

4. More Personalized Customer Service

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Credit unions take great satisfaction in offering more customized service than big banks. Many times, members have direct contact to a representative knowledgeable in their financial circumstances. This degree of focus guarantees rapid and thorough resolution of your issues.

5. Community-Focused Values

Daniel Frese on Pexels

Daniel Frese on Pexels

Credit unions run with an eye toward serving the community above their own profit margins. Many credit unions reinvest in neighborhood projects, helping local companies, education, and community activities. Usually lacking in banks is this feeling of community.

6. Less Aggressive Marketing

AS Photography on Pexels

AS Photography on Pexels

Unlike large banks that bombard you with nonstop advertising and marketing, credit unions sometimes rely on member satisfaction and word-of-mouth. Their attention is more on the caliber of the service than on ostentatious marketing initiatives. This helps you to enjoy their products more comfortably.

7. Easy Access to Local Branches

Kindel Media on Pexels

Kindel Media on Pexels

Many times, credit unions are small local businesses that give branch access a priority. To suit to their members, many credit unions provide longer hours or more flexible service choices. When handling in-person banking, this can save time and aggravation.

8. Profit-Sharing with Members

Ketut Subiyanto on Pexels

Ketut Subiyanto on Pexels

Should you be a member of a credit union, the institution may award dividend or profit-sharing. Credit unions run non-profit businesses; hence, any additional income is returned to members either as reduced rates or more returns. For the institution as well as its members, this generates a win-win situation.

9. Fewer Hidden Fees

Liliana Drew on Pexels

Liliana Drew on Pexels

For services including paper statements, account management, and ATM use, banks are well known for levying hidden costs. With their open fee policies, credit unions help you avoid unannounced charges. This guarantees that you exactly know what to expect.

10. Better Financial Education Resources

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Credit unions frequently give their members free financial education tools including personal budgeting guidance and seminars. These courses can raise your general financial literacy and enable you to make better decisions about money. Conversely, banks usually provide few choices for educational background.

11. Member-Only Perks and Discounts

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Credit unions regularly provide members special discounts and benefits such travel offers or reduced insurance premiums. These advantages are meant to improve the members’ financial situation.

12. More Flexible Lending Requirements

Kaboompics.com on Pexels

Kaboompics.com on Pexels

When it comes to loan applications, credit unions can have less strict lending policies than regular banks. This helps people with less than stellar credit be eligible for loans. If you struggle to be approved anyplace, a credit union could be the answer.

13. Non-Commercial Focus

Christina Morillo on Pexels

Christina Morillo on Pexels

Credit unions are non-commercial; hence, its objective is to provide member needs rather than concentrate on profit maximizing. You are therefore handled more like a collaborator than a client. More ethical and people-centric banking follows from this non-commercial emphasis.

14. Access to Cooperative Investments

Artem Podrez on Pexels

Artem Podrez on Pexels

Many times, credit unions give members access to invest in cooperative businesses. Usually safer and with better returns than those of regular investing accounts are these investments. This allows members of credit unions a special approach to increase their fortune.

15. Low Minimum Balances

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Many credit unions let you open low minimum balance account openings. For those who might not have enough money to put beforehand, this makes it more approachable. Low fees and balance requirements help you to manage your money far more easily.

16. Greater Transparency

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Transparency in financial operations is well-known about credit unions. They simplify for members where their money is going and how decisions are being taken. This guarantees members of their financial institution feel confident and helps to create trust.

17. No Pressure to Upsell Products

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

To its clients, banks sometimes try to promote extra goods or services include loans or credit cards. Conversely, credit unions concentrate just on serving their members’ needs and do not promote extraneous items. This helps members prevent needless or unwelcome spending.

18. Stronger Member Advocacy

cottonbro studio on Pexels

cottonbro studio on Pexels

On behalf of their members, credit unions campaign to affect policies that will help consumers. They actively support stronger rules and more equitable financial practices. Banking with a credit union helps you support a company advocating your financial rights.

19. Less Bureaucracy

Mikael Blomkvist on Pexels

Mikael Blomkvist on Pexels

Given their smaller size, credit unions usually require less bureaucracy in making decisions. Speaking with someone about a problem is simpler if you want responses without working through layers of administration. This guarantees faster and more seamless banking.

20. Ownership of Your Financial Institution

fauxels on Pexels

fauxels on Pexels

You start to share ownership of a credit union when you join one. This entitles you to vote on significant decisions and participate in the credit union’s operations. Owning makes one proud and involved in the financial services you use.

- Tags:

- Perks

- Credit Union

- Advantages

- Offers