20 Ways to Automate Your Finances and Save Time

Here are simple and effective strategies to streamline your financial tasks, from automating bill payments to setting savings goals. Learn how these 20 methods can help you save time, reduce stress, and achieve your financial goals more efficiently.

- Tricia Quitales

- 7 min read

When you want to save time and stay on top of your financial goals, automating your finances can make all the difference. You can focus on what’s most important while making sure your money is working for you by setting up processes to do things like save, invest, and pay bills. This article talks about 20 useful ways to automate your finances for you to easily take charge of your financial future.

1. Set Up Automatic Bill Payments

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

You will never miss a bill payment due date if you set up regular payments for them. This can help you avoid late fees and always pay your bills on time every month. There are a lot of service companies and credit cards that allow you to set up automatic payments.

2. Automate Your Savings with Direct Deposits

Elise on Pexels

Elise on Pexels

Putting some of your paychecks into a savings account every time you get paid is one of the best ways to save money. Because of this, you will have to save money before you can spend it. Your savings will become a regular habit if you set specific percentages or fixed amounts.

3. Use Budgeting Apps to Track Spending

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Budgeting apps keep track of your spending and sort your bills into groups so you can see exactly where your money is going. Most of the time, these apps can connect to your bank accounts and credit cards to give you real-time information about your money. Using them can help you stick to your budget and avoid spending too much.

4. Set Up Automatic Investment Contributions

Alesia Kozik on Pexels

Alesia Kozik on Pexels

When you invest regularly, your money will grow over time. It doesn’t matter if you have a retirement account or a taxable broking account—you can set up automatic payments to them. This method makes it less tempting to try to time the market, which helps you stick to your investment goals.

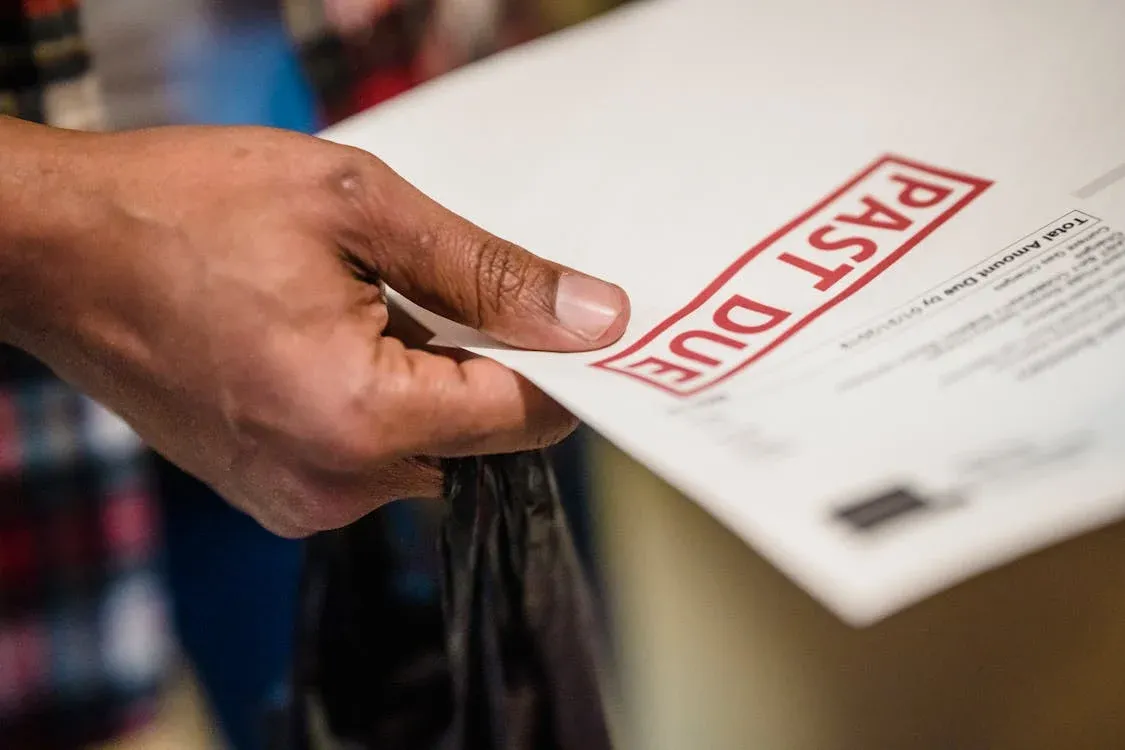

5. Automate Debt Payments

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Setting up regular payments can help you ensure you don’t miss any due dates while paying off your debt. This helps you stay on track with your payback plan and avoid fees. You can get ahead without having to do anything by setting up automatic payments for loans, credit cards, and other bills.

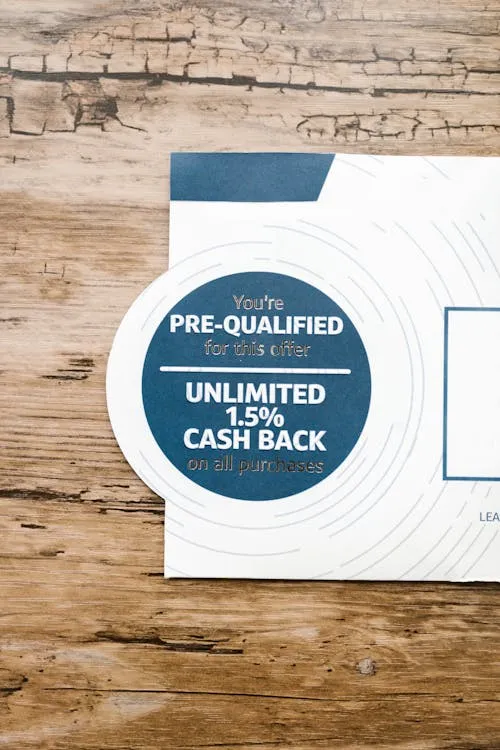

6. Use Cashback and Rewards Programs Automatically

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Many credit cards give you cash back or points every time you use them. If you set up automatic payments on credit cards that give you points, you’ll never miss a chance to get the benefits. Some credit card companies also let you set up automatic points redemption, saving you time and effort.

7. Automate Charity Donations

cottonbro studio on Pexels

cottonbro studio on Pexels

If you give to charity often, you might want to set up automatic payments. Donating this way helps you stick to it and ensures you support the causes you care about without having to think about it every time. You can set the amount every month or let it depend on how much money you make.

8. Set Up Emergency Fund Contributions

maitree rimthong on Pexels

maitree rimthong on Pexels

For financial security, you need to have a backup fund. You can set up regular transfers to a different account to automatically put money into your emergency fund. This keeps your safety net always being built, so you don’t have to remember to do it by hand.

9. Use Robo-Advisors for Investing

Yan Krukau on Pexels

Yan Krukau on Pexels

Robo-advisors can take care of your investments for you, building a diverse portfolio based on how much risk you are willing to take. These sites make investing easy with low fees and management that you don’t have to do yourself. They rebalance your portfolio and reinvest earnings for you, which saves you time and work.

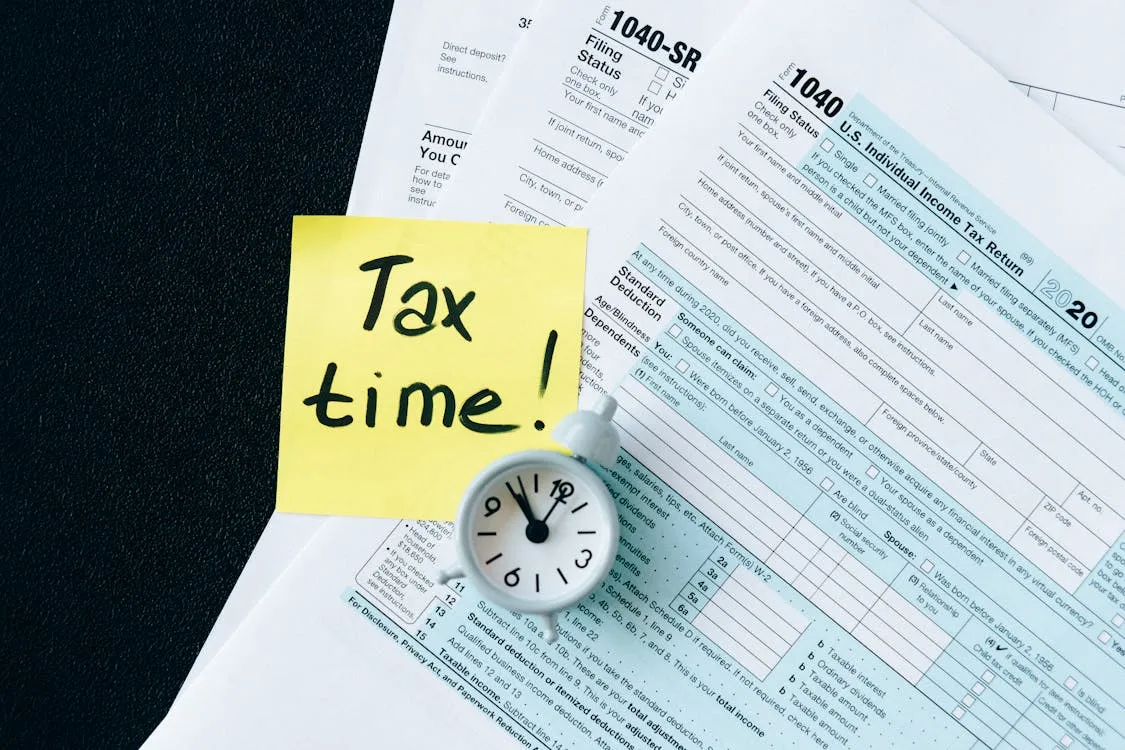

10. Automate Your Tax Payments

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Setting up automatic tax payments can help people who are self-employed or whose income changes from time to time avoid any shocks at tax time. You can know how much tax you owe and have payments taken care of immediately. This makes it easier to remember to pay your taxes on time every three months.

11. Set Alerts for Due Dates and Balances

Nicola Barts on Pexels

Nicola Barts on Pexels

You can set alerts for many banks and apps to let you know when your bills are due or when your balance hits a certain level. This keeps you on top of your bills and keeps you from going overdrawn. By setting these alerts to go off automatically, you can manage your money more easily.

12. Automate Your Credit Score Monitoring

rupixen on Pixabay

rupixen on Pixabay

There are apps and services that can keep an eye on your credit score for you. These tools will let you know if your score changes in a big way, like if there is a new question or a missed payment. This keeps you updated on your finances and saves you the trouble of checking it by hand.

13. Use Automatic Savings Apps

MariusMB on Pixabay

MariusMB on Pixabay

You can get apps to round up your purchases to the nearest dollar and keep the change for you. Micro-savings apps that do it for you make it easy to save small amounts of money over time. It might not seem like much at first, but it adds up over time without you thinking about it.

14. Set Up Recurring Transfers for Financial Goals

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you want to save for a trip, a new car, or retirement, setting up automatic transfers to accounts that are just for that purpose is a great way to do it. You can set up a shift every month to ensure that your goals are met without you having to do anything. This method can help you stick to your long-term financial plans.

15. Automate Subscriptions and Membership Renewals

BiljaST on Pixabay

BiljaST on Pixabay

Many people forget about memberships or contracts that charge them every month until they get charged for them. You can always be on top of the refresh process if you set it up to run itself. You can also check these services often to ensure they’re still worth the money.

16. Use Pre-Paid Accounts for Budgeting

stevepb on Pixabay

stevepb on Pixabay

Because they add a set amount every month, these cards will help you stick to a budget. By using them for extra spending, you put a cap on yourself and are less likely to go over budget. This kind of technology can help you keep your budget in better shape.

17. Set Up Auto-Pay for Insurance Premiums

Vlad Deep on Pexels

Vlad Deep on Pexels

Setting up auto-pay for your insurance payments will make sure you don’t forget to pay them. Having your insurance paid for regularly keeps your policy from lapsing, whether it’s for your car, your health, or your renters’. Depending on your insurance, you can set up payments to happen every month, every three months, or every year.

18. Use Digital Wallets for Easy Payments

Kaboompics.com on Pexels

Kaboompics.com on Pexels

It’s safe to save your credit and debit card information in these apps, which makes purchases faster and easier. When you connect these wallets to your bank accounts, you can pay faster and better plan your money.

19. Set Up Automatic Mortgage Payments

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

By setting up automated mortgage payments, you will never miss a payment deadline and avoid expensive late fees. Many lenders allow you to arrange recurring monthly payments deducted from your bank account. One of your largest monthly expenses is kept under control by this simple habit.

20. Automate Investment Rebalancing

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Many financial tools allow you to rebalance your account for yourself. This maintains your investment mix within your comfort with risk and financial objectives. Setting this up to run itself will free you from constantly monitoring and altering your assets.