20 Ways to Boost Your Retirement Savings Even Late in Life

It’s never too late to build a solid retirement fund—smart strategies and small tweaks can supercharge your savings, even if you're starting late.

- Sophia Zapanta

- 6 min read

Saving for retirement late in life may seem impossible, but with the right steps, you can still create financial security. By maximizing income, cutting unnecessary expenses, and leveraging smart investments, you can accelerate your savings quickly. The key is to act now, stay consistent, and make every dollar work harder for your future.

1. Delay Retirement a Few Years

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

Staying in the workforce longer means more time to save and fewer years to rely on your retirement funds. Even working a few extra years can significantly increase your savings and Social Security benefits. This also gives your investments more time to grow, reducing the risk of outliving your money. If you enjoy your job, consider transitioning to part-time instead of full retirement.

2. Max Out Your Retirement Contributions

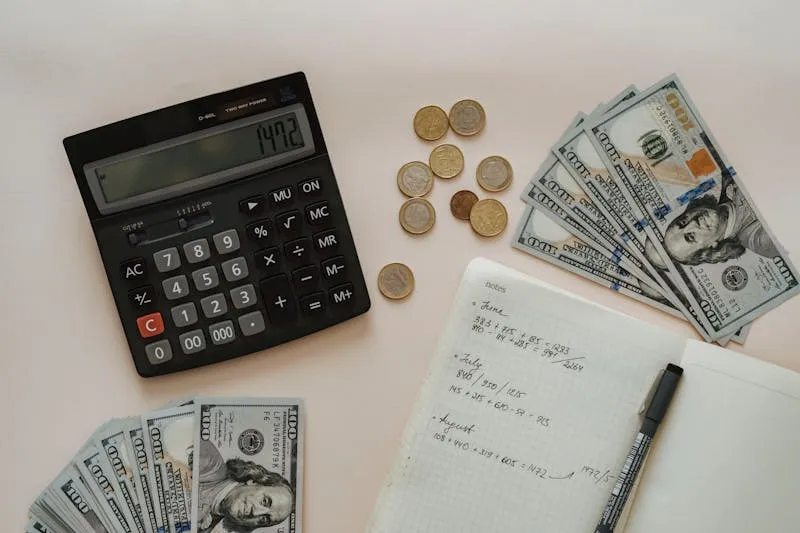

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If you’re over 50, take advantage of catch-up contributions in retirement accounts like 401(k)s and IRAs. These allow you to contribute extra money beyond the standard limits. Even a few years of maxed-out contributions can make a big difference. Automate deposits so you don’t miss out on potential savings.

3. Cut Unnecessary Expenses

olia danilevich on Pexels

olia danilevich on Pexels

Review your budget and eliminate anything you don’t truly need. Downgrade expensive subscriptions, dine out less, and reconsider luxury purchases. Redirect those savings into your retirement account instead. Small sacrifices now can mean a much more comfortable future.

4. Downsize Your Home

RDNE Stock project on Pexels

RDNE Stock project on Pexels

A smaller home means lower mortgage payments, reduced maintenance costs, and lower property taxes. Selling your current home and moving to a cheaper location can free up a large sum for retirement savings. Consider renting if it makes more financial sense. Plus, less space means less clutter—win-win!

5. Get a Side Gig

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Freelancing, consulting, or even driving for a rideshare service can generate extra income for savings. Look for skills you already have that could bring in cash with minimal effort. Online platforms make it easy to start a side hustle from home. Even an extra few hundred dollars a month can have a big impact over time.

6. Delay Social Security Benefits

Kampus Production on Pexels

Kampus Production on Pexels

The longer you wait to claim Social Security (up to age 70), the larger your monthly payments will be. If you claim early at 62, you’ll get significantly less each month for life. Delaying even a few years can mean thousands of extra dollars annually. If possible, rely on other income sources first and let your benefits grow.

7. Invest Wisely

Kaboompics.com on Pexels

Kaboompics.com on Pexels

At this stage, your investment strategy should balance growth with risk management. Avoid overly aggressive stocks but don’t go ultra-conservative either. Consider index funds or dividend-paying stocks for steady income. A financial advisor can help create a portfolio that fits your timeline and risk tolerance.

8. Take Advantage of Employer Matches

cottonbro studio on Pexels

cottonbro studio on Pexels

If your company offers a 401(k) match, contribute at least enough to get the full match—otherwise, you’re leaving free money on the table. It’s one of the easiest ways to boost savings fast. Even if you’ve ignored this benefit before, it’s never too late to start. Think of it as an instant raise for your retirement.

9. Pay Off High-Interest Debt

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Credit card debt and high-interest loans eat away at your potential savings. Focus on eliminating them as quickly as possible so you can redirect those payments toward retirement. Consider debt consolidation or refinancing for better interest rates. The less debt you carry, the more financial freedom you’ll have later.

10. Consider a Health Savings Account (HSA)

Pixabay on Pexels

Pixabay on Pexels

If you have a high-deductible health plan, an HSA offers tax advantages while letting you save for medical expenses in retirement. Contributions are tax-deductible, and withdrawals for healthcare costs are tax-free. After age 65, you can even use HSA funds for non-medical expenses (though they’ll be taxed like an IRA). Future medical costs are inevitable—why not prepare now?

11. Move to a Lower-Cost Area

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Relocating to a state with no income tax or a lower cost of living can stretch your savings further. Research places where housing, groceries, and healthcare are cheaper. Some states even offer tax breaks for retirees. You don’t have to move across the country—just finding a more affordable city nearby could help.

12. Monetize Your Skills or Hobbies

Alan Quirván on Pexels

Alan Quirván on Pexels

Turn your expertise into cash by teaching, tutoring, or selling handmade goods. Platforms like Etsy, Udemy, and Fiverr make it easy to reach paying customers. You don’t have to build a full-time business—just earning extra here and there can boost savings. If you love what you’re doing, it won’t even feel like work.

13. Automate Your Savings

Pixabay on Pexels

Pixabay on Pexels

Set up automatic transfers to your retirement accounts so saving becomes effortless. Even small, consistent contributions add up over time. This removes the temptation to spend money elsewhere. Out of sight, out of mind—until retirement, when you’ll be glad you did it.

14. Rent Out a Room or Property

Ivan Samkov on Pexels

Ivan Samkov on Pexels

If you have extra space, renting it out can generate passive income. Consider listing a spare room on Airbnb or renting a second property long-term. Even if it’s temporary, this income can give your savings a quick boost. Just make sure to check local rental laws before diving in.

15. Stay Healthy to Reduce Future Costs

SHVETS production on Pexels

SHVETS production on Pexels

Healthcare is one of the biggest expenses in retirement, so taking care of yourself now can save you thousands later. Exercise regularly, eat well, and keep up with preventive care. Avoiding chronic illnesses means fewer medical bills and a longer, more enjoyable retirement. Bonus: You’ll feel better, too!

16. Review and Optimize Insurance Plans

Leeloo The First on Pexels

Leeloo The First on Pexels

You might be paying too much for insurance you don’t need or have gaps in coverage. Compare plans and adjust your policies to fit your current needs. Long-term care insurance is also worth considering to protect against future healthcare costs. A little research now can lead to big savings later.

17. Take Advantage of Senior Discounts

cottonbro studio on Pexels

cottonbro studio on Pexels

Many businesses offer discounts for people over 50, but you have to ask. From travel to groceries, these small savings add up over time. Sign up for senior discount programs to make the most of every dollar. Why pay full price when you don’t have to?

18. Sell Unused Items

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Declutter your home and sell things you no longer need. Use online marketplaces, garage sales, or consignment shops to turn your stuff into cash. Even if each item sells for a small amount, it all adds up. Plus, a cleaner home can bring peace of mind.

19. Consult a Financial Advisor

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

A good advisor can help create a strategy tailored to your late-stage retirement goals. They’ll help you maximize returns, minimize taxes, and avoid costly mistakes. Even a single session can provide valuable insights. Think of it as an investment in your future.

20. Stay Positive and Keep Going

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Feeling behind on retirement savings can be overwhelming, but stress won’t help. Focus on what you can do and take action today. Every step forward, no matter how small, brings you closer to a secure future. It’s never too late to build the retirement you deserve.

- Tags:

- Savings

- Retirement

- Finance

- investing