20 Ways to Build Better Money Habits

Building better money habits is all about making smart, simple choices that help you manage your finances with ease and confidence.

- Sophia Zapanta

- 6 min read

Money habits can feel overwhelming, but the truth is, they don’t have to be. By focusing on simple strategies and consistent effort, you can take control of your finances without stress. These 20 practical tips will help you save more, spend smarter, and feel confident about your financial future.

1. Know Where Your Money Goes

Kaboompics.com on Pexels

Kaboompics.com on Pexels

If you don’t track your spending, it’s easy to lose control of your money. Write down every expense for a month—you might be surprised where your cash disappears. Awareness is the first step to better money habits. Tracking your expenses will give you a clearer picture of where adjustments are needed.

2. Make a Budget You Can Actually Stick To

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Budgets shouldn’t feel like a punishment. Create one that includes your needs and a little fun. Sticking with a plan is easier when it feels realistic, not restrictive. When your budget aligns with your lifestyle, you’re more likely to stay committed.

3. Automate Your Savings

Lukas on Pexels

Lukas on Pexels

Treat your savings like a bill you can’t skip. Set up automatic transfers to your savings account every payday. You’ll grow your savings without even thinking about it. Automation takes the decision-making out of saving, making it effortless and consistent.

4. Separate Needs from Wants

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Before buying something, ask yourself: do I really need this, or just want it? This simple question can stop impulse buys in their tracks. Your future self will thank you. By distinguishing needs from wants, you prevent unnecessary spending and prioritize what truly matters.

5. Start an Emergency Fund

Pixabay on Pexels

Pixabay on Pexels

Life happens, and it’s not always cheap. Build a small emergency fund to handle unexpected expenses without stress. Even starting with $500 can make a big difference. An emergency fund gives you peace of mind and prevents financial chaos when life throws you a curveball.

6. Use Cash More Often

Jonathan Borba on Pexels

Jonathan Borba on Pexels

Paying with cash makes you feel the cost in a way cards don’t. It’s harder to overspend when you’re physically handing over money. Plus, you’ll think twice before buying something unnecessary. Cash makes your spending more tangible, which helps curb impulse purchases.

7. Sleep on Big Purchases

Marcial Comeron on Pexels

Marcial Comeron on Pexels

Impulse buys can feel great in the moment but can lead to regret later. Wait at least 24 hours before making a big purchase. Chances are, you’ll either lose interest or feel more confident about your decision. This simple strategy gives your emotions time to settle, helping you make more rational choices.

8. Pay Yourself First

Leeloo The First on Pexels

Leeloo The First on Pexels

Saving should come before spending. Even if it’s just a small percentage of your income, prioritize putting money aside for yourself. Building wealth starts with valuing your future. When you pay yourself first, you ensure your future financial health is secure.

9. Learn to Say No

cottonbro studio on Pexels

cottonbro studio on Pexels

Sometimes, sticking to your financial goals means saying no to plans or purchases. It’s okay to prioritize your money over temporary pleasures. True friends will understand. Saying no now can help you say yes to more significant financial goals in the future.

10. Cut Subscriptions You Don’t Use

John Tekeridis on Pexels

John Tekeridis on Pexels

Monthly subscriptions can quietly drain your budget. Review them regularly and cancel the ones you rarely use. That extra money could go toward something more meaningful. Eliminating unused subscriptions can free up cash for things you truly value or need.

11. Shop with a List

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Walking into a store without a plan is asking for trouble. Make a list and stick to it to avoid buying things you don’t need. It’s a small habit that can save you big money. Having a list keeps you focused and reduces the chances of impulse buying.

12. Cook at Home More Often

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Eating out adds up quickly. Learn to cook a few simple meals at home—it’s healthier and cheaper. Bonus: you’ll appreciate dining out more when it’s a treat, not a habit. Cooking at home not only saves money but can be a fun and rewarding experience.

13. Invest in Quality, Not Quantity

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Sometimes, cheap is expensive. Spend a little more upfront on high-quality items that last longer. Over time, you’ll save by avoiding constant replacements. Quality purchases may cost more initially, but their durability saves you money in the long run.

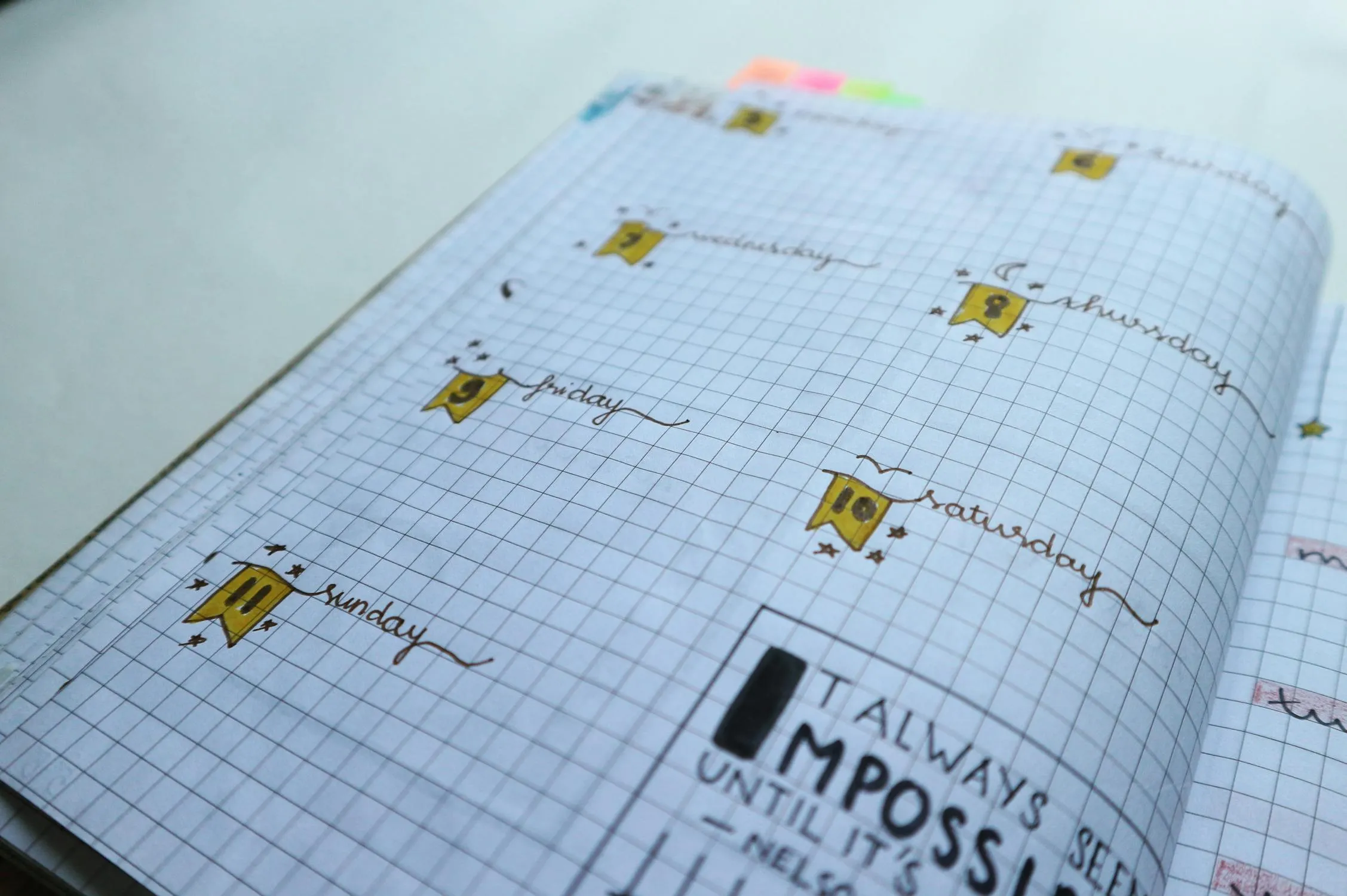

14. Set Specific Financial Goals

Bich Tran on Pexels

Bich Tran on Pexels

It’s easier to save when you know what you’re saving for. Whether it’s a vacation, a new car, or early retirement, give your money a purpose. Goals turn dreams into plans. Having specific financial goals keeps you focused and motivated on your path to success.

15. Pay Off High-Interest Debt First

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Debt with high interest rates is like a financial black hole. Focus on paying it off as quickly as possible. Once it’s gone, you’ll have more freedom with your money. Eliminating high-interest debt fast can reduce the amount you pay overall, freeing up funds for saving and investing.

16. Use Rewards Wisely

energepic.com on Pexels

energepic.com on Pexels

Credit card rewards can be a smart way to save, but only if you pay your balance in full every month. Use them for things you need, not as an excuse to spend more. Free flights or cash back? Yes, please! Maximizing credit rewards helps you make the most of your spending without falling into debt.

17. Learn to DIY

Blue Bird on Pexels

Blue Bird on Pexels

You don’t need to hire someone for every little thing. Learn basic skills like cooking, repairs, or sewing to save money. Plus, there’s something satisfying about doing it yourself. DIY skills not only save money but empower you to take control of your personal and home-related needs.

18. Plan for Fun, Too

Bich Tran on Pexels

Bich Tran on Pexels

Saving money doesn’t mean being boring. Set aside a “fun fund” for guilt-free spending on things you love. Enjoying your money is part of staying motivated to manage it well. Having a fun fund ensures you don’t feel deprived while still sticking to your financial goals.

19. Educate Yourself About Money

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Knowledge is power, especially when it comes to finances. Read books, listen to podcasts, or watch videos about personal finance. The more you learn, the better decisions you’ll make. Investing time in financial education equips you with the tools to make smart, informed decisions.

20. Review Your Progress Regularly

Kindel Media on Pexels

Kindel Media on Pexels

Check in with your financial goals every month. Celebrate your wins, even if small, and adjust your plan if needed. Tracking progress keeps you motivated to stay on track. Regular reviews ensure you’re on course and allow you to make adjustments when necessary to meet your financial objectives.