20 Ways to Maximize Your Tax Return as a Single Parent

Taking care of money can be hard when you're a single parent, but your tax return could give you a nice cash boost. Many tax breaks and strategies can help you get the most out of your refund and feel less stressed about money.

- Tricia Quitales

- 7 min read

There are a lot of things you have to do as a single parent, and knowing about the tax benefits you can get can help ease some of the financial stress. There are many tax credits, deductions, and strategies you can use to get the most money back on your taxes. Some of these are for children, dependents, and household costs. Because of these 20 tips, you can improve your financial situation and increase your chances of getting a bigger refund. It’s important to know about the best options for single parents so that you can get the most out of tax time.

1. Claim the Earned Income Tax Credit (EITC)

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

The EITC is a tax credit that can be refunded and is meant to help people with low to moderate incomes, especially those who have children. This credit can give you a big boost on your tax return if you qualify. How much you can get depends on how much money you make, how many people depend on you, and how you file your taxes.

2. Child Tax Credit

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Up to $2,000 can be given to each child under 17 who qualifies for the Child Tax Credit. This credit is meant to lower the tax you have to pay, and you might even get a refund. There are certain income requirements you must meet in order to get a refund of up to $1,400 per child.

3. Head of Household Filing Status

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you are a single parent, you may be able to file as the head of household, which gives you a bigger standard deduction. This status can help you get a bigger refund and lower the amount of income that is taxed. Ensure you meet the requirements, such as paying more than half of your family’s expenses.

4. Dependent Care Credit

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

You might get the Dependent Care Credit if you pay for child care or care for a dependent while you work. This credit can help lower the cost of child care by paying for some of the eligible costs. How much credit you get is based on how much money you make and how much you pay for care.

5. Child and Dependent Care Flexible Spending Account (FSA)

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

You can save money before taxes for eligible child care costs by putting money into a Dependent Care FSA through your employer. You may get a bigger tax refund if this lowers your taxable income. It’s important to keep track of the costs that can be reimbursed.

6. Standard Deduction for Single Parents

Mark Youso on Pexels

Mark Youso on Pexels

When filing as a single parent, the standard deduction can help you save money because it lowers your taxable income. The standard deduction for people who file as head of household in 2025 is $20,800. Your taxed income may go down if you take this deduction.

7. Education Tax Credits

Zen Chung on Pexels

Zen Chung on Pexels

You may get tax breaks if you pay for school for yourself or your kids. The American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) are two examples. These credits may help you pay for school by lowering the cost of fees, tuition, and books. They’re useful if you or your kid are in school or college.

8. Child Support Deduction

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

You can’t deduct child support payments, but if the other parent has custody, you may be able to get money back from their tax return. However, if you have custody of the child, you can claim them as a dependent and get other tax breaks. Ensure you know the exact tax rules about who gets custody and pays child support.

9. Alimony Deduction

RDNE Stock project on Pexels

RDNE Stock project on Pexels

If you pay alimony to a former spouse, you can write that off on your taxes. This deduction could lower your taxable income, giving you a bigger tax refund. Remember that this deduction is only for divorce agreements finalized before 2019 and used in the old tax rules.

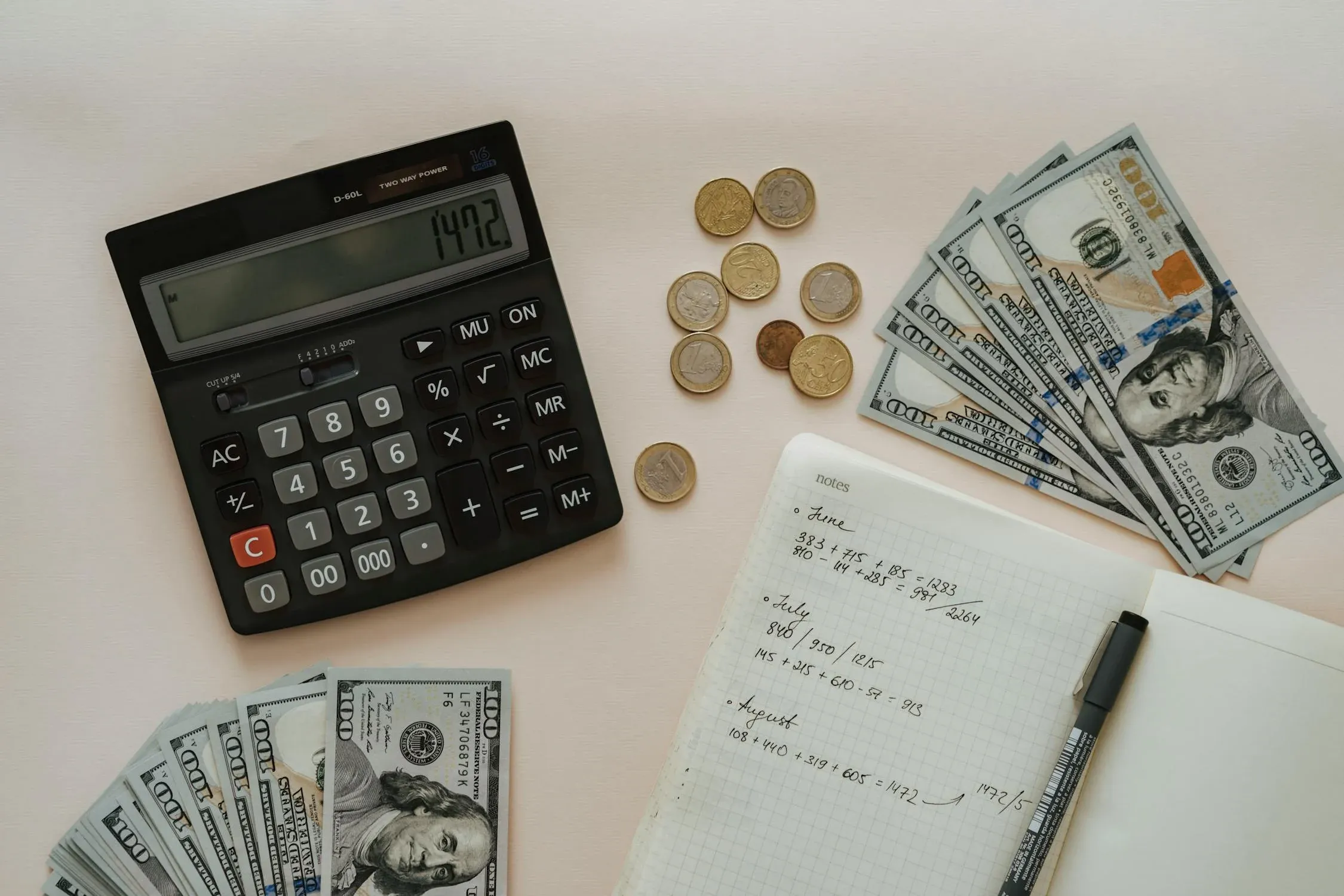

10. Track Work-Related Expenses

olia danilevich on Pexels

olia danilevich on Pexels

As a single parent, you may be able to deduct costs related to your job, like a home office or office supplies. Ensure you keep track of any costs you can deduct related to your job. You can get a bigger tax refund if you lower your taxable income with these deductions.

11. Contribute to an IRA

Anna Nekrashevich on Pexels

Anna Nekrashevich on Pexels

You can lower your annual taxable income by putting money into an Individual Retirement Account (IRA). If you put money into a traditional or Roth IRA, your contributions may be tax-deductible, or your money may grow tax-free. It’s a great way to save money over time and get tax breaks at the same time.

12. Medical Expense Deductions

Kaboompics.com on Pexels

Kaboompics.com on Pexels

You might be able to deduct big medical bills that account for more than 7.5% of your income. This includes trips to the doctor, prescriptions, and health insurance premiums. If your medical costs qualify, keeping detailed records can help you get a bigger tax return.

13. Tax Preparation Fees

Leeloo The First on Pexels

Leeloo The First on Pexels

If you list your deductions, you can write off the fees you paid for tax software or a tax preparer. You can use this to help pay for the help you get from a tax professional. You can deduct these costs from your taxes if they involve filing your return.

14. Filing Early

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

If you file your tax return early, you may be able to avoid making mistakes and get your refund faster. It also gives you more time to get any other papers you might need. If you file your taxes early, you can use your refund right away.

15. Claiming Other Dependents

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

If you are financially responsible for someone else, like your elderly parents, you may be able to get extra credits or deductions. This can include the $500 Credit for Other Dependents for people who depend on you but are not children. Ensure you know who can be listed as a dependent on your tax return.

16. Use the Standard Deduction for Your Situation

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

When you’re a single parent, the standard deduction is often better than itemizing your deductions. If you choose the standard deduction, your taxable income goes down quickly. Every year, review your tax situation to see whether standard deductions or itemizing will save you the most money.

17. Claiming the Adoption Credit

Kindel Media on Pexels

Kindel Media on Pexels

You might get the adoption tax credit if you’ve adopted a child. This credit helps cover some of the costs of adopting a child, like legal fees and travel costs. The adoption credit can be very helpful, so if it applies to you, make sure you use it.

18. Consider Filing for Unemployment Benefits

Polina Tankilevitch on Pexels

Polina Tankilevitch on Pexels

You might get some tax breaks if you were unemployed and got unemployment benefits. However, even though unemployment benefits are taxed, there may be ways to lower your tax bill. Keeping track of any paperwork related to your unemployment will help you get these deductions.

19. Donations to Charity

RDNE Stock project on Pexels

RDNE Stock project on Pexels

You can deduct charity donations if you list them separately on your tax return. This includes giving money, clothes, or other things. Some taxpayers may still be able to get a charitable deduction even if they are not itemizing because of special COVID-19 relief rules.

20. Keep Good Records

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

To get the most out of your tax return, you should keep detailed records of all your costs, from medical bills to child care. If you keep good records, you won’t miss any credits or deductions. Track your spending all year with spreadsheets or apps. This will make tax time easier.