20 Ways to Prepare Financially for a Recession

Get to know these strategies to safeguard your finances and stay resilient during economic downturns.

- Daisy Montero

- 4 min read

Tough times do not have to leave your wallet empty. Small financial changes can make a big difference before uncertainty hits. Building a strong savings habit, finding ways to earn extra income, and making smarter spending choices can keep you ahead. These practical tips help you stay financially steady when the economy takes a turn.

1. Build an Emergency Fund

Alexander Mils on Unsplash

Alexander Mils on Unsplash

Having savings set aside for emergencies can keep you afloat during financial hardships. Aim for at least three to six months’ worth of expenses in an easily accessible account. This cushion helps cover essentials when income becomes uncertain.

2. Reevaluate Your Budget

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Take a hard look at your spending and cut back on non-essential expenses. Focus on needs over wants and redirect savings into emergency funds or debt repayment. A well-planned budget keeps your finances in check during uncertain times.

3. Pay Down High-Interest Debt

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Reducing debt before a recession hits can free up cash for essential expenses. To minimize financial strain, prioritize high-interest loans like credit cards. The less debt you have, the more financial flexibility you gain.

4. Diversify Your Income

Jakub Zerdzicki on Pexels

Jakub Zerdzicki on Pexels

Relying on one income stream can be risky in an economic downturn. Consider freelancing, side gigs, or investments to generate additional earnings. Extra sources of income provide a safety net if your primary job is affected.

5. Cut Unnecessary Expenses

Kostiantyn Li on Unsplash

Kostiantyn Li on Unsplash

Now is the time to trim spending on subscriptions, dining out, and impulse purchases. Small adjustments can make a big difference in long-term savings. Redirecting these funds to essentials strengthens financial security.

6. Stay Informed About the Economy

Turgut Ka on Pexels

Turgut Ka on Pexels

Understanding economic trends helps you anticipate financial challenges. Keep up with market shifts, interest rates, and employment trends. Being informed allows you to make proactive financial decisions.

7. Review Insurance Policies

Kampus Production on Pexels

Kampus Production on Pexels

Ensure your health, home, and auto insurance policies provide adequate coverage. Unexpected expenses can arise, and the right insurance prevents financial setbacks. Regular reviews help you adjust coverage as needed.

8. Monitor Your Credit Score

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Keeping an eye on your credit score helps you maintain financial health. Good credit can secure better loan rates and financial opportunities. Regularly reviewing your score helps you catch potential errors or fraud early.

9. Strengthen Your Investments

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Make sure your investment portfolio is balanced and diversified. Spreading out investments can reduce risk during economic downturns. Long-term financial security comes from smart and steady investments.

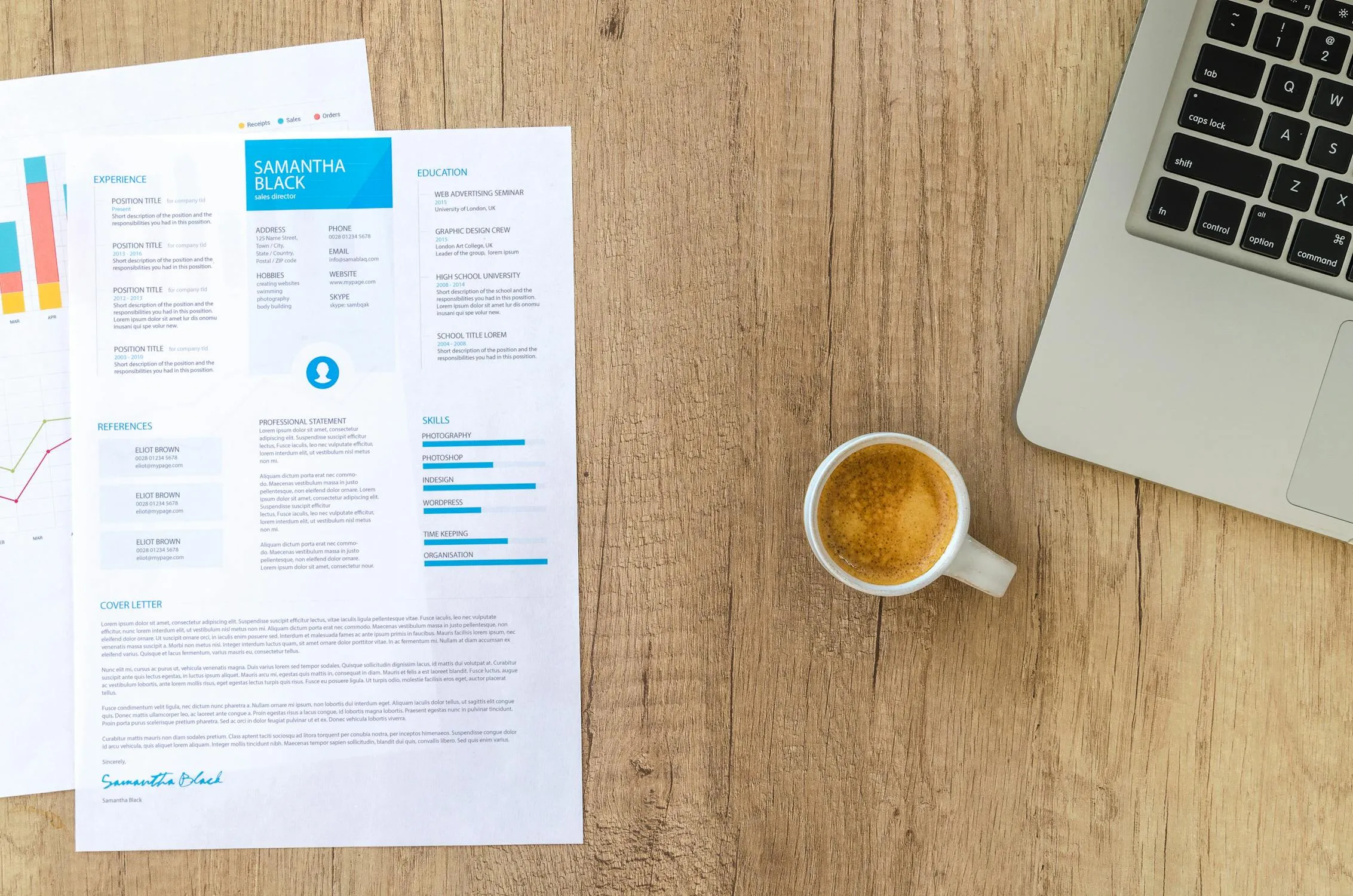

10. Update Your Resume and Skills

Lukas on Pexels

Lukas on Pexels

A recession can impact job stability, so staying prepared is key. Keep your resume updated and build new skills to remain competitive. Being proactive can open new career opportunities if the job market shifts.

11. Reduce Monthly Bills

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Lowering utility costs, negotiating subscriptions, and switching to cost-effective plans can free up extra cash. Small changes add up over time, and reducing unnecessary expenses strengthens financial stability.

12. Shop Smart for Essentials

Gustavo Fring on Pexels

Gustavo Fring on Pexels

Buying in bulk, using coupons, and choosing store brands can stretch your budget further. Planning meals ahead reduces food waste. Strategic shopping helps you save without sacrificing quality.

13. Automate Your Savings

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Setting up automatic transfers ensures you consistently put money aside. Even small amounts build up over time. This habit strengthens your financial cushion before tough times hit.

14. Start a Side Hustle

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

Extra income from freelancing or a small business can provide financial security. Choose something flexible that aligns with your skills. Having an additional source of income is a game-changer during uncertain times.

15. Open a High-Yield Savings

Pixabay on Pexels

Pixabay on Pexels

Earning more on your savings helps maximize your money. Look for accounts offering competitive interest rates. Higher returns mean better financial growth over time.

16. Improve Financial Literacy

Mathieu Stern on Pexels

Mathieu Stern on Pexels

Learning about personal finance helps you make informed money decisions. Books, podcasts, and courses offer valuable insights. Knowledge is a powerful tool for financial security.

17. Plan for Retirement

Vodafone x Rankin everyone.connected on Pexels

Vodafone x Rankin everyone.connected on Pexels

A recession should not derail long-term financial goals. Keep contributing to your retirement fund as much as possible. Staying consistent ensures future financial security.

18. Consider Recession-Proof Careers

Ron Lach on Pexels

Ron Lach on Pexels

Jobs in healthcare, utilities, and essential services tend to be more stable. If your industry is vulnerable, expanding your skill set can open new opportunities. Stability matters when the economy shifts.

19. Use Budgeting Tools

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Apps and spreadsheets can help track spending and manage finances efficiently. Seeing where your money goes makes it easier to cut unnecessary costs. Smart budgeting keeps you prepared for financial changes.

20. Stay Adaptable

MART PRODUCTION on Pexels

MART PRODUCTION on Pexels

Financial plans should be flexible to adjust to economic shifts. Regularly reviewing your finances helps you stay prepared. Being proactive puts you in control no matter what the future holds.