20 Ways to Retire Earlier Than You Ever Expected

This article talks about useful ways to retire younger than most people ever thought possible. As long as people have good money habits, plan their days carefully, and live a simple life, anyone can retire early. With these tips, you can make smart choices that will help you achieve financial independence faster.

- Tricia Quitales

- 6 min read

A lot of people want to retire early, but they have to do more than just wish for it to come true. It requires careful planning of money, a change in how they think about money, and the formation of habits that put saving and spending first. This article will talk about 20 tried-and-true ways to retire faster than planned, ranging from cutting costs to making more money. Whether you’re just starting out or already on your way to being financially independent, these tips will help you find retirement faster.

1. Automate Your Savings

cottonbro studio on Pexels

cottonbro studio on Pexels

Make sure that money is sent automatically to your savings account every month. Save money before you spend it, and your retirement savings will grow without you having to do anything. Automation also takes away the chance to spend the money you were trying to save.

2. Cut Back on Unnecessary Expenses

Ba Tik on Pexels

Ba Tik on Pexels

Look at how you normally spend your money and find places where you can save money. Making small changes, like canceling services or eating out less, can add up to big savings over time. Then, these savings can be put into bank accounts to make more money.

3. Invest in Low-Cost Index Funds

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Low-cost index funds let you build wealth without having to pay a lot of fees. The returns on these funds are steady over the long term because they follow the stock market’s success. If you keep your money saved for a long time, it can grow, which can help you retire earlier.

4. Downsize Your Home

Ketut Subiyanto on Pexels

Ketut Subiyanto on Pexels

If you don’t need a big house, you might want to sell it and move into a smaller one. A smaller home means less money for repairs and property taxes, which can be used to make investments. This is very helpful if you live in an expensive area.

5. Build Multiple Streams of Income

Greta Hoffman on Pexels

Greta Hoffman on Pexels

Having more than one way to make money will definitely help you reach your retirement goals faster. This could mean having a side job, investing, or doing unpaid work. Spreading out your income ensures you don’t depend on one paycheck to pay for everything.

6. Pay Off High-Interest Debt Quickly

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Get rid of debts with high interest rates, like credit card bills, to save more money. Getting out of debt can slow you down if you want to retire early. You can put that money towards building wealth if you pay it off faster.

7. Embrace a Minimalist Lifestyle

Maksim Goncharenok on Pexels

Maksim Goncharenok on Pexels

Spending less and saving more can happen at the same time when you live with less. Being thoughtful about what you buy and how you live is what this means: not depriving yourself. When you have less, you spend less, which speeds up the process of retiring.

8. Contribute to Retirement Accounts Regularly

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Put as much money as you can into retirement accounts like an IRA or 401(k). These accounts let your savings grow tax-free, which speeds up the process of getting rich. If employer matching is possible, make sure to use it to its fullest.

9. Invest in Real Estate

energepic.com on Pexels

energepic.com on Pexels

Real estate can be a safe way to get rich and make money without much work. You can earn extra money to help you retire early by buying rental properties or investing in real estate investment companies (REITs). If you want to improve your financial future, think about how homes can go up in value over time.

10. Learn About Tax Efficiency

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

Learn how taxes affect your investments and eliminate as many of those effects as possible. Using tax-advantaged accounts and tactics can keep more of your money. A tax-efficient strategy helps you get the most out of your money and retire faster.

11. Delay Gratification

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Instead of buying things immediately, practice putting them off and focus on long-term goals. Whether putting off an expensive trip or not buying something on a whim, fighting the urge to spend now can pay off big in the long run. With this habit, you can save and spend more money.

12. Start Investing Early

nattanan23 on Pixabay

nattanan23 on Pixabay

Your money will have more time to grow if you start saving early. When you give interest a lot of time to build up, it works best. Small investments made early on can help you retire in peace.

13. Create a Detailed Budget

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Make it a habit to keep track of your spending and income to find places where you can save money. You can see where your spending is too high and fix the problem by making a budget. Because of this, you can save more each month for retirement.

14. Live Below Your Means

olia danilevich on Pexels

olia danilevich on Pexels

As your pay rises, don’t let your lifestyle go up too much. You don’t have to spend more just because you make more money. You can save and invest a bigger chunk of your income if you don’t change how much you spend.

15. Use the “Buy Used” Strategy

cottonbro studio on Pexels

cottonbro studio on Pexels

You can save a lot of money by buying used things, like cars and furniture. The loss of value of new things doesn’t have as much of an effect on used items. You can put this extra money right into your retirement fund.

16. Set Specific Retirement Goals

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Set clear goals for how and when you want to quit. You can make a plan to get the money you need if you know how much you need. These goals will also keep you inspired and on track as you work to become financially independent.

17. Avoid Lifestyle Inflation

jasmin chew on Pexels

jasmin chew on Pexels

When your pay increases, you might want to improve your way of life but don’t. Instead, put the extra money and keep living the same way you did before the rise. This habit helps you stay on track with your plans for retirement.

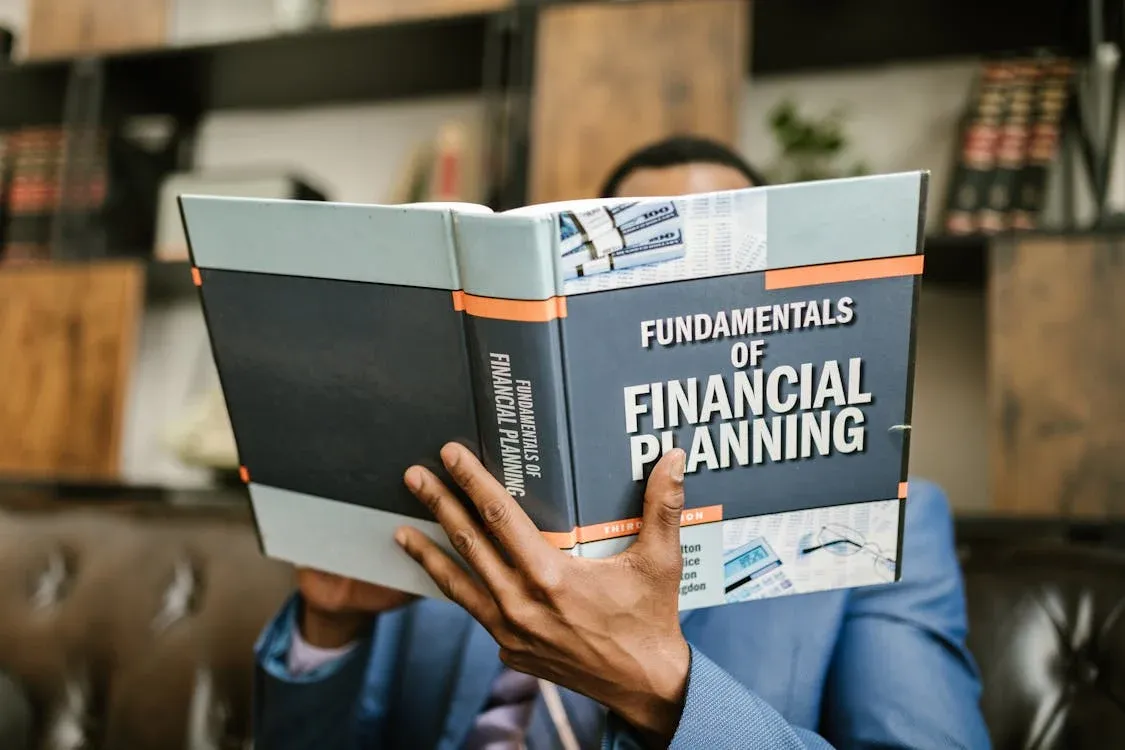

18. Increase Your Financial Literacy

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Take the time to learn about investing and personal cash. People who know a lot about making money are rich. You’ll be able to retire earlier if you make better financial decisions when you know more about money.

19. Cut Out High-Cost Entertainment

Vanessa Loring on Pexels

Vanessa Loring on Pexels

Instead of going on expensive trips, look into options that are cheaper or even free. Start doing things you enjoy that don’t cost a lot of money, like reading or camping. Use the money you’ve saved to make investments for the future.

20. Focus on Health and Wellness

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Medical bills can eat away at your retirement savings if you don’t take care of your health. To escape expensive medical bills in the future, work out, eat well, and see your doctor regularly. Putting your health first will help you pay less for medical bills, which means you can save more for retirement.

- Tags:

- Retirement

- Plan

- money

- Savings