20 Ways to Stop Impulse Spending

Spending without thinking can quickly throw you off track with your money goals, causing stress and debt you don't need. When feelings or a lack of planning cause people to buy things they didn't mean to, this often happens. The good news is that you can stop these bad habits and start managing your money better in some ways.

- Tricia Quitales

- 7 min read

This piece gives you 20 useful and simple tips on how to stop spending money without meaning to. They are meant to help you be more intentional with your money. For example, you could set clear financial goals or practice mindfulness before making a buy. These tips are meant to help you build better habits and improve your general financial health, whether you’re struggling with the urge to shop online or in a store. You can take small steps toward more responsible spending and better financial health by using these tips in your daily life.

1. Set Clear Financial Goals

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Set clear financial goals before you start spending money on whims. You will more likely stick to your budget if you know exactly what you’re working toward. Clear goals help you stay on track and avoid buying things you don’t need.

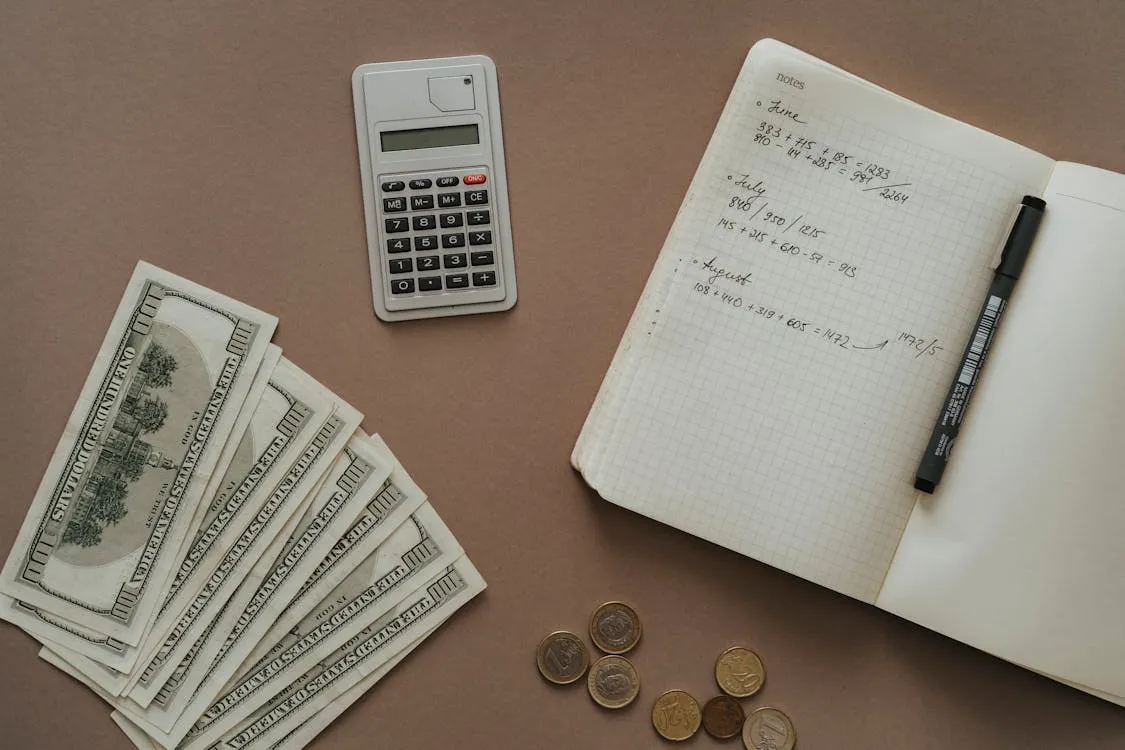

2. Create a Detailed Budget

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Budget can help you keep track of your income and spending, which can help you see where you’re spending too much. With a budget, you can plan your spending ahead of time, which makes it less likely that you’ll buy something out of the blue. Always check your budget to make sure you’re on the right track.

3. Use the 24-Hour Rule

Ron Lach on Pexels

Ron Lach on Pexels

If you don’t need to buy something immediately, wait for 24 hours. This break gives you a chance to think about whether you need the item or are just buying it because you feel like it. Most of the time, the urge to buy goes away after some time, and you can make a better choice.

4. Avoid Shopping When Emotional

AS Photography on Pexels

AS Photography on Pexels

Feelings, especially worry or boredom, can make you spend money without thinking about it. When you’re down, it’s easy to believe that something new will make you feel better. You can avoid making emotional purchases by finding other ways to deal with your problems, like going for a walk or talking to a friend.

5. Unsubscribe from Promotional Emails

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

Stores send marketing emails to encourage you to buy. The deals they offer are often too good to pass up. Unsubscribe from these emails to avoid being tempted and to stop receiving sales pitches constantly. This can help you focus on what you really need instead of giving in to sales.

6. Limit Your Access to Credit Cards

Leeloo The First on Pexels

Leeloo The First on Pexels

Your credit cards will help you spend less if you don’t use them as much or at all. If you pay with cash, you can stick to your budget and not go into debt. Also, it’s easy to keep track of your bills.

7. Shop with a List

Jack Sparrow on Pexels

Jack Sparrow on Pexels

Always bring a list with you to the store and stick to it. With a buying list, you don’t have to wander around stores aimlessly and buy things you don’t need. If you have a plan, you will only buy what you need.

8. Practice Mindful Shopping

Gustavo Fring on Pexels

Gustavo Fring on Pexels

Before you buy something, consider whether it will improve your life or just meet a short-term need. When you shop mindfully, you pay attention to the present and know why you are getting what you are. Giving something some thought before you buy it will help you stay on track with your goals.

9. Set Up an Emergency Fund

ds_30 on Pixabay

ds_30 on Pixabay

An emergency fund is money that is set aside for things like car repairs or hospital bills that come out of the blue. Knowing you have a safety net makes you less likely to spend money without thinking and more likely to put savings first. This fund can give you peace of mind and keep you from spending money you don’t need to.

10. Track Your Spending

olia danilevich on Pexels

olia danilevich on Pexels

Every time you spend money, write it down so you can see where your money is going. If you really pay attention to how much you spend, you might notice trends of acting without thinking. Figuring out these times can help you make smarter choices in the future and avoid buying things you don’t need.

11. Avoid Window Shopping

Collis on Pexels

Collis on Pexels

Window shopping is a surefire way to buy something without thinking about it. Looking at things you don’t need can make you want to buy them immediately. Do not even look at something if you do not need it. This will help you save money.

12. Set Spending Limits

cottonbro studio on Pexels

cottonbro studio on Pexels

Set a monthly cap on how much you can spend on things that aren’t necessary and stick to it. You are less likely to buy things that could hurt your funds when you have a clear limit in place. Setting limits makes people think more about their choices before they buy.

13. Think About Future Needs

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Think about how the thing you want to buy will affect your future before you buy it. Will it help you reach your money goals, or will you have less money for more important things? Seeing things in the big picture can help you choose if it’s worth it.

14. Find Non-Material Ways to Reward Yourself

Kate Trifo on Pexels

Kate Trifo on Pexels

If you always buy things as rewards, you should find other ways to treat yourself. It’s not necessary to spend money to feel good. Take a walk in the park, eat something nice, or work out with friends. This will help you reduce your need for material things.

15. Avoid Sales Traps

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Things that are on sale aren’t always a good deal, even if they look like they are. You shouldn’t buy something if you don’t need it or have planned to. Focus on your money goals instead of the savings that come along with them.

16. Automate Savings

Tima Miroshnichenko on Pexels

Tima Miroshnichenko on Pexels

Setting up savings account payments that happen on their own can help you save money without even thinking about it. You’re less likely to spend that money without thinking when you save it automatically. You should also try to save money before you think about spending it.

17. Use Cash Instead of Cards

RDNE Stock project on Pexels

RDNE Stock project on Pexels

When you pay for things with cash, you must stick to your budget because you can’t get it back. With this real cap, you won’t be able to spend more than you have, like you might with a credit card. Having a set amount of cash on hand for extra spending will help you stay within your budget.

18. Take Advantage of “No-Spend” Challenges

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Set a goal to not spend money on things that aren’t necessary for a certain amount of time, like a week or a month. These tasks help you change how you spend your money and become more aware of your urges. It makes you feel good about your money and gives you a sense of success.

19. Seek Support from Others

cottonbro studio on Pexels

cottonbro studio on Pexels

Sharing with a friend or family member about what you buy on a whim can help you stay on track. It is easier to stay on track and resist the urge to spend when you have someone to check in with. Having other people support you can help you stay on track with your cash goals.

20. Review Your Purchases Regularly

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

At the end of every month, take some time to go over what you bought. Going over what you got can help you decide if each was necessary or just a whim. Once you see trends, you can change your habits and make smarter choices about your money in the future.