20 Ways to Teach Your Kids About Money

Helping kids develop financial literacy early sets them up for lifelong success in managing money wisely.

- Chris Graciano

- 4 min read

Teaching children about money doesn’t have to be difficult; it can be enjoyable, participatory, and age appropriate. Children may appreciate the importance of working, saving, and spending properly when they are taught about money. This listicle provides 20 practical techniques for teaching your children excellent financial habits.

1. Start with a Piggy Bank

ClickerHappy on Pexels

ClickerHappy on Pexels

Encourage kids to save by giving them a piggy bank. Watching their savings grow helps them understand delayed gratification. Once full, let them count and deposit the money into a real bank account.

2. Give an Allowance for Chores

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Assign age-appropriate tasks and reward them with a small allowance. This will teach kids that money is earned through effort and help them develop a strong work ethic.

3. Open a Savings Account

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Take them to the bank to open a savings account in their name. Show them how deposits and interest work. This makes saving money feel more real and exciting.

4. Set Financial Goals

Alex P on Pexels

Alex P on Pexels

Encourage kids to save for a specific item, such as a toy or a bike. Setting goals teaches patience and financial planning. Celebrate when they reach their savings target.

5. Use Cash for Purchases

cottonbro studio on Pexels

cottonbro studio on Pexels

Let them physically handle money when buying something. This makes spending feel more tangible than using cards or digital payments. Seeing money leave their hands reinforces the value of every dollar.

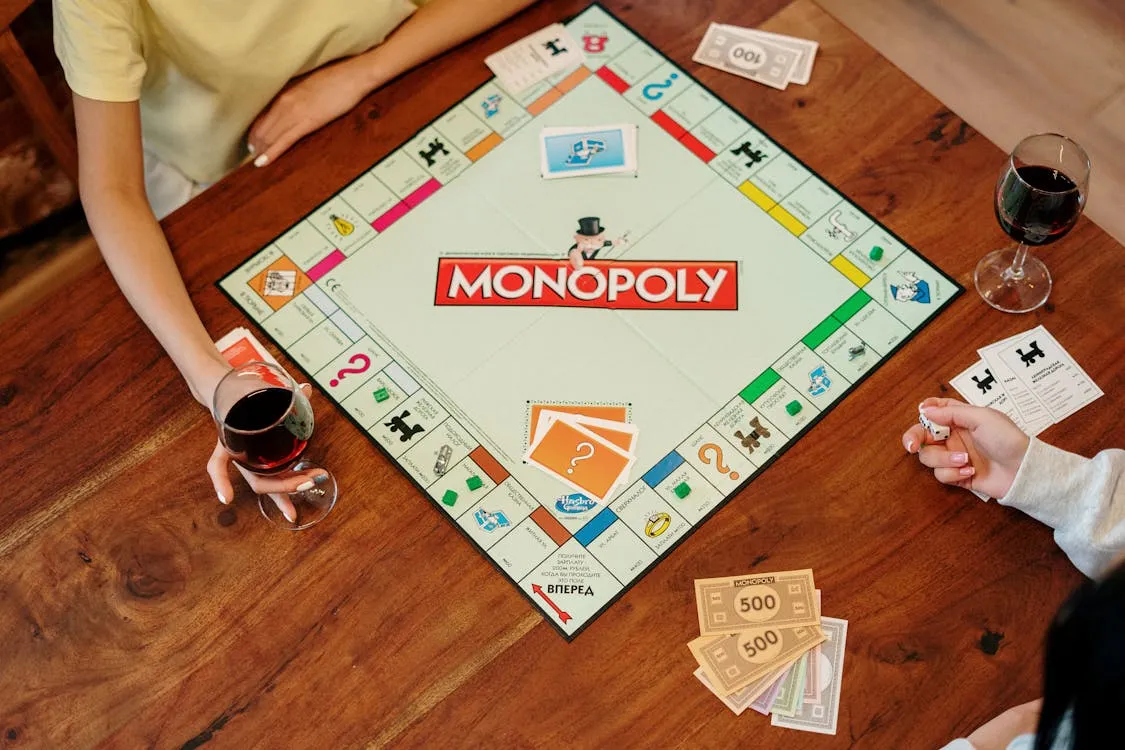

6. Play Money-Related Games

cottonbro studio on Pexels

cottonbro studio on Pexels

Board games like Monopoly or The Game of Life introduce financial concepts in a fun way. These games teach kids about earning, spending, and investing. Playing together provides opportunities to discuss smart money decisions.

7. Explain the Difference Between Needs and Wants

Kindel Media on Pexels

Kindel Media on Pexels

Help kids distinguish between essentials and luxuries. When shopping, discuss why some purchases are necessary while others are optional. This builds critical thinking about spending habits.

8. Introduce Budgeting Basics

Kaboompics.com on pexels

Kaboompics.com on pexels

Create a simple budget with categories for saving, spending, and giving. Let kids decide how to allocate their allowance or earnings. Budgeting instills discipline and financial responsibility.

9. Encourage Smart Shopping

Kindel Media on Pexels

Kindel Media on Pexels

Show kids how to compare prices and look for deals. Explain the benefits of waiting for sales rather than impulse buying. This teaches them to be savvy consumers.

10. Lead by Example

Kindel Media on Pexels

Kindel Media on Pexels

Kids learn financial habits by watching their parents. Demonstrate responsible spending, saving, and budgeting in everyday life. Transparency about money decisions helps them develop good habits.

11. Talk About Debt and Credit

Kampus Production on Pexels

Kampus Production on Pexels

Explain how borrowing money works and why it’s important to repay debts. Use simple examples like lending them money for a purchase and tracking repayment. Teaching about credit early prevents future financial mistakes.

12. Show How Investing Works

Kindel Media on Pexels

Kindel Media on Pexels

Introduce basic investment concepts by explaining stocks, bonds, and interest. Use real-life examples, like how a savings account earns interest over time. If possible, let them invest a small amount in a stock and watch its performance.

13. Encourage Entrepreneurship

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Help kids start a small business, like a lemonade stand or selling handmade crafts. This teaches them about profits, expenses, and customer service. Running a small venture builds confidence and financial awareness.

14. Teach About Taxes

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Explain that money earned isn’t all take-home pay due to taxes. Show them a paycheck stub or receipts with sales tax included. Understanding taxes helps them appreciate income planning.

15. Set Up a Giving Fund

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Encourage charitable giving by helping kids set aside a portion of their money for donations. Let them choose a cause they care about. Giving teaches compassion and financial generosity.

16. Discuss the Importance of Emergency Savings

Tara Winstead on Pexels

Tara Winstead on Pexels

Explain why having money set aside for unexpected situations is essential. Use relatable examples, like saving for a broken toy or an urgent school expense. This instills the habit of financial preparedness.

17. Teach Patience with Delayed Gratification

Towfiqu barbhuiya on Pexels

Towfiqu barbhuiya on Pexels

Help kids understand that waiting leads to better financial outcomes. Practice this by encouraging them to save up for a purchase instead of buying immediately. Delayed gratification strengthens money management skills.

18. Involve Them in Family Budgeting

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Let kids see how household expenses are managed. Show them how you plan for groceries, utilities, and entertainment. This makes financial planning more relatable and less abstract.

19. Use Real-World Money Experiences

Nicola Barts on Pexels

Nicola Barts on Pexels

Let them pay at the store or help calculate the tip at a restaurant. Hands-on experiences make financial concepts easier to grasp. They also build confidence in handling money.

20. Keep the Conversation Going

Ketut Subiyanto on Pexels

Ketut Subiyanto on Pexels

Financial education isn’t a one-time lesson; it’s ongoing. Regular discussions about money reinforce positive habits. Encourage curiosity and answer their questions honestly.