I Asked ChatGPT How to Live Comfortably on Minimum Wage—Here’s Its 14-Step Survival Plan

Earning minimum wage does not need to mean perpetual financial struggle.

- Daisy Montero

- 5 min read

This listicle presents 14 actionable steps that help you budget wisely, reduce costs, build small savings, and create opportunities for extra income. It also highlights how to lean on available support systems, rethink your mindset, and set up habits that gradually improve your financial security.

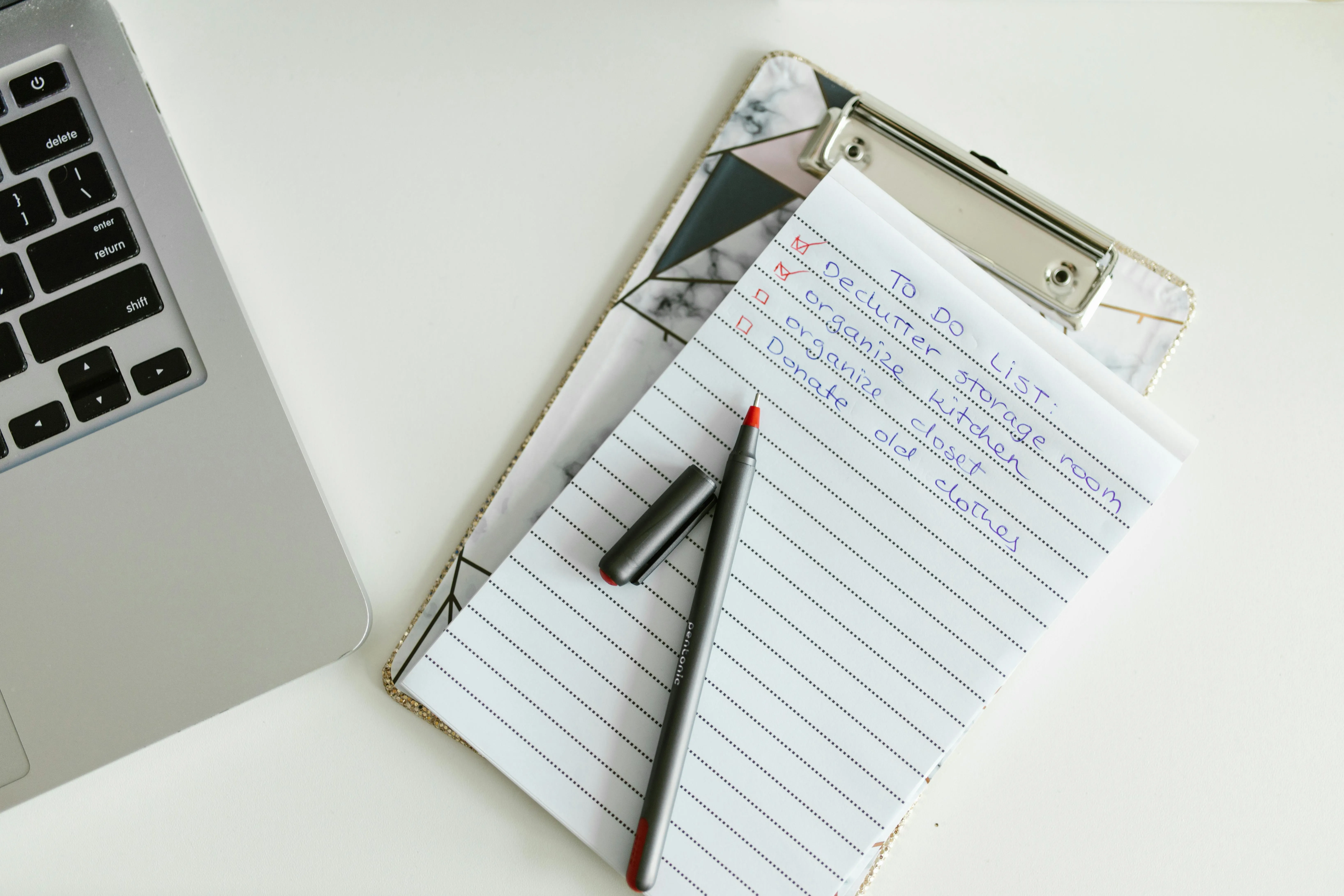

1. 1. Track Every Peso Coming In and Going Out

cottonbro studio on Pexels

Start by writing down your actual income and every expense in one place. For a worker earning minimum wage, the margins are small, so the visibility matters even more. Once you see where your money goes, you gain control. That awareness alone often reveals small ways to redirect funds into savings or necessities.

2. 2. Build a Lean Monthly Budget That Respects Your Income

Katie Harp on Pexels

Create a budget that fits your actual wages rather than your ideal income. Use multiples finer than “needs, wants, savings.” For example, allocate fixed amounts for rent, food, transport, and small savings. Tracking monthly helps avoid surprise shortfalls. Over time, you’ll find where you can trim without sacrificing essentials.

3. 3. Slash Food Costs Without Starving Yourself

Cybèle Canteau on Pexels

Food can eat up a big slice of income when you’re on a tight budget. Plan meals, buy bulk or generic brands, and cook at home as often as possible. Use local markets or discounted options. A modest but consistent saving on meals can free up money for transport or savings.

4. 4. Optimize Transport and Housing Costs

Nothing Ahead on Pexels

When income is limited, the big fixed costs, such as rent, utilities, and travel, matter most. Consider shared housing or cheaper commute options like public transport or a bike rather than a car. Reducing these fixed burdens gives more breathing room. Every peso saved here has outsized value.

5. 5. Avoid High‑Interest Debt and Unnecessary Fees

Aukid phumsirichat on Pexels

Taking on debt is riskier when the wage is low because repayments squeeze any margin you might have. Avoid payday loans, high‑interest credit cards, or late fees. If you must borrow, do so only for investments such as training or income-boosting activities. Protect your future self.

6. 6. Start Saving Something — Even If It’s Tiny

Karola G on Pexels

A wage at the minimum level does not preclude saving. Even putting aside small amounts regularly creates a habit and gives you leverage. Automatic transfers into savings or even a jar can build a buffer. That buffer might cover emergencies rather than forcing burnout or debt.

7. 7. Explore Additional Income Streams or Side‑Gigs

Karola G on Pexels

Because minimum wage often leaves little slack, you may need an alternative income to feel more comfortable. A side job, freelance work, or selling something you make can raise your total earnings. Use extra income strategically, either pay off debt or reinforce savings rather than just increasing comfort.

8. 8. Invest in Your Skills to Raise Your Earning Potential

MART PRODUCTION on Pexels

Staying on the same wage forever means your margins get squeezed by inflation. Use free or low‑cost training, workshops, or certification to upgrade your skills. A small income bump can change everything when your baseline is low. Think of this as an investment in your earning power.

9. 9. Keep Self‑Care and Mental Health in Check

Karola G on Pexels

Budgeting and survival mode can feel draining. Ignoring your well‑being risks burnout and poor decisions. Make time for rest, free or low‑cost activities, and relationships that support you. Staying healthy mentally and physically helps you stay consistent with your plan.

10. 10. Use Available Support Programs and Community Resources

Yan Krukau on Pexels

Many regions offer assistance for food, healthcare, transport, or training for low‑wage workers. Investigate what’s available in your area — it could relieve the burden. Incorporate that help into your budget honestly. It changes the equation, gives you more room to breathe.

11. 11. Time‑Block for Productivity and Smart Work Habits

Obsolete Lense on Pexels

When income is tight, every hour matters. Organize your days to maximize productive time, both at your current job and for side work. Sleep, rest, commute, and meal‑prep all matter. Efficient use of time means less wasted money and more opportunity.

12. 12. Set Short‑Term Goals and Track Progress

RDNE Stock project on Pexels

It is easier to stay motivated when you have goals like “save $5,000 in six months” or “raise side income by $3,000/month." Write these down, track monthly, and adjust if needed. Achieving small wins builds momentum and gives you proof that you are moving forward instead of being stuck.

13. 13. Identify and Cut Hidden Costs That Drain Your Budget

cottonbro studio on Pexels

Costs like streaming subscriptions, convenience meals, and small impulse purchases add up. Audit your spending for things you barely use or can go without. Even modest reductions free up money for savings or an emergency buffer. Over time, the cumulative effect matters.

14. 14. Treat the Minimum Wage Period as a Launchpad, Not a Permanent State

Karola G on Pexels

If you earn minimum wage now, don’t resign yourself to it being forever. Use it as a foundation — learn, save, build skills, and network so the next step up is realistic. This mindset shift changes how you feel about your earnings and future. When you believe you can improve your income, you act differently.