I Asked ChatGPT How to Prepare for a Recession—Here’s the 12-Point Financial Checklist

I asked ChatGPT how to prepare for a recession, and it gave me a 12-point checklist designed to help everyday Americans stay financially steady during uncertain times.

- Chris Graciano

- 4 min read

Recessions can feel unpredictable, but having a plan makes the impact far less scary. ChatGPT broke down the essential steps that strengthen your finances before layoffs, price hikes, or market dips hit. These practical moves help you stay calm, stay prepared, and stay in control no matter what the economy does.

1. 1. Build a Cash Buffer That Covers Your Essentials

Pixabay on Pexels

Having extra cash set aside gives you room to breathe if income slows or unexpected bills pile up. Even a small cushion can help you avoid debt when things get tight. Building it little by little is more realistic than waiting for the “perfect” time.

2. 2. List Every Monthly Expense to See What You Can Cut

Kuncheek on Pexels

You can’t make smart financial changes if you don’t know where your money goes. Tracking every bill, subscription, and habit exposes areas where you can save without feeling deprived. A few small cuts often add up to surprising relief.

3. 3. Pay Down High-Interest Debt First

Reynaldo #brigworkz Brigantty on Pexels

High-interest balances become even more stressful when the economy turns shaky. Reducing them now keeps your monthly obligations lighter and your stress levels lower. Every dollar you eliminate becomes more freedom later.

4. 4. Strengthen Your Credit Score Before You Need It

cottonbro studio on Pexels

A good credit score gives you better options if you ever need a loan or line of credit. Simple habits like paying on time and keeping balances low make a measurable difference. Strong credit becomes a safety net when times get tougher.

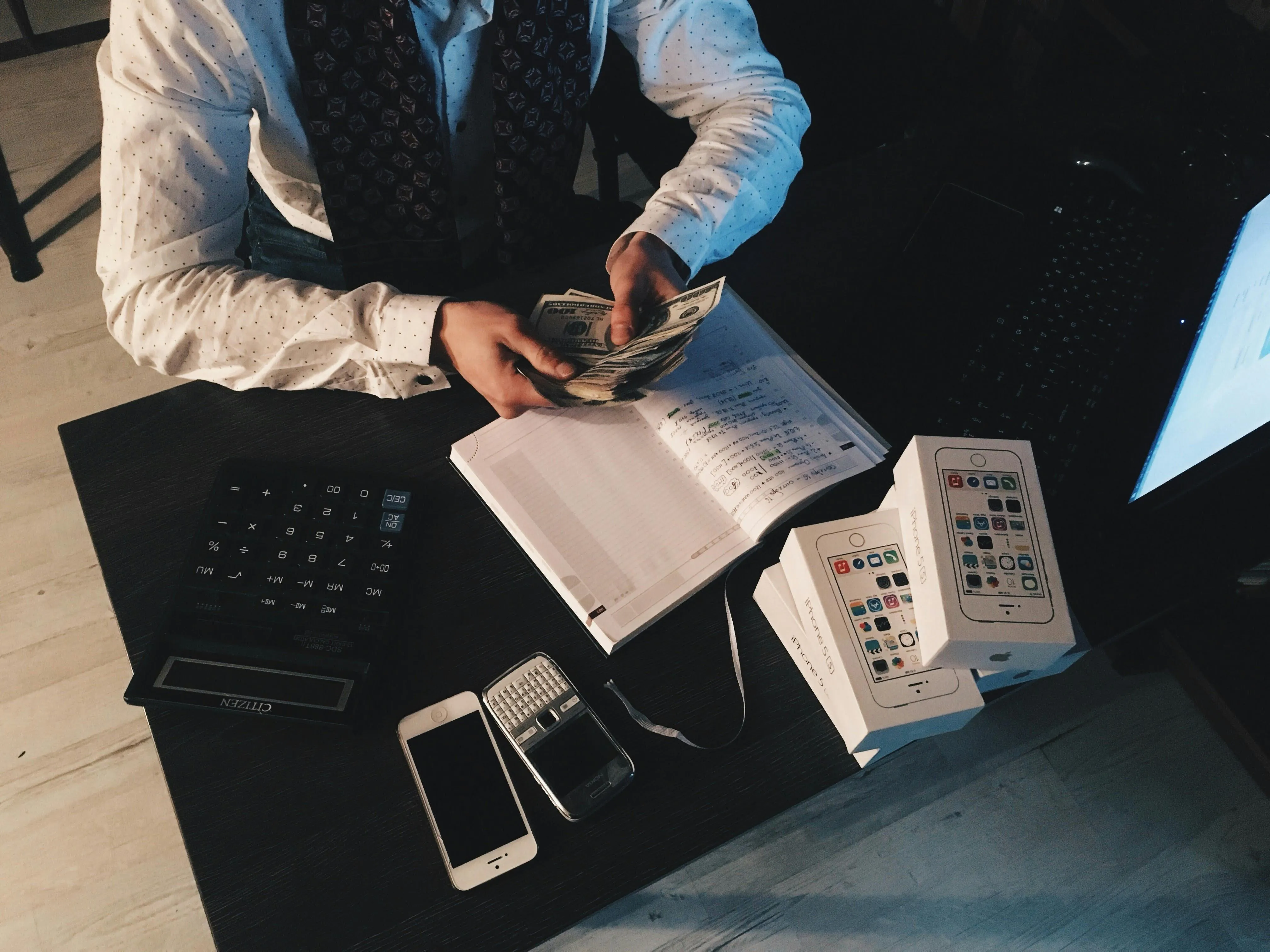

5. 5. Increase Your Income However You Can

Anri Lilkov on Pexels

A recession hits harder when you rely on just one paycheck. Picking up a side gig, selling unused items, or asking for extra hours brings in helpful money you can save. Even temporary boosts create long-term stability.

6. 6. Keep Your Resume and Skills Updated

cottonbro studio on Pexels

Employment shifts happen faster during downturns, so staying ready protects your independence. Refreshing your resume and improving your skills give you a stronger fallback if opportunities change. Preparation reduces fear and increases options.

7. 7. Build a Pantry of Essentials Gradually

Jacob McGowin on Unsplash

Stocking up on basic items helps you avoid higher prices when inflation spikes. Buying a few extras each week keeps things affordable and stress-free. A small reserve keeps your household running smoothly during rough patches.

8. 8. Avoid Big Purchases Unless They’re Truly Necessary

Towfiqu barbhuiya on Unsplash

Large expenses drain savings at the exact moment you need them most. Holding off on upgrades, luxury items, or major commitments gives you more stability. Waiting can protect you from regret if the economy takes a sharper turn.

9. 9. Review Your Insurance to Make Sure You’re Covered

RDNE Stock project on Pexels

Gaps in coverage become painfully expensive when money gets tight. Looking over your policies helps you avoid surprises if something goes wrong. The right protection saves you from financial shocks you can’t afford during a recession.

10. 10. Strengthen Relationships With People You Trust

Igal Ness on Unsplash

A solid support network helps you get through tough financial seasons with less stress. Friends, family, and coworkers offer advice, opportunities, and encouragement. Community becomes an emotional and practical resource when uncertainty grows.

11. 11. Keep Investing, but Stick to Safer, Long-Term Choices

Yashowardhan Singh on Unsplash

Markets dip during recessions, but disciplined investing often pays off over time. Staying steady and choosing lower-risk options keeps you from reacting out of fear. Slow and consistent always beats panicked decisions.

12. 12. Create a Simple Plan You Can Follow Under Stress

Karola G on Pexels

A recession feels less overwhelming when you already know your next steps. Writing down your priorities keeps you focused even when emotions run high. A steady plan gives you peace of mind when everything else feels shaky.